7 Powerful Benefits of Contactless Payments via POS Systems You Can’t Ignore

In an increasingly digital world, contactless payments have emerged as a game-changer in how consumers pay for goods and services. Driven by advancements in technology and changing consumer preferences, contactless payments offer a fast, secure, and convenient alternative to traditional payment methods. When integrated with Point of Sale (POS) systems, contactless payments provide significant benefits for both businesses and customers. Let’s explore the advantages of contactless payments via POS systems and why they’re becoming a crucial feature for modern businesses.

1. Speed and Efficiency

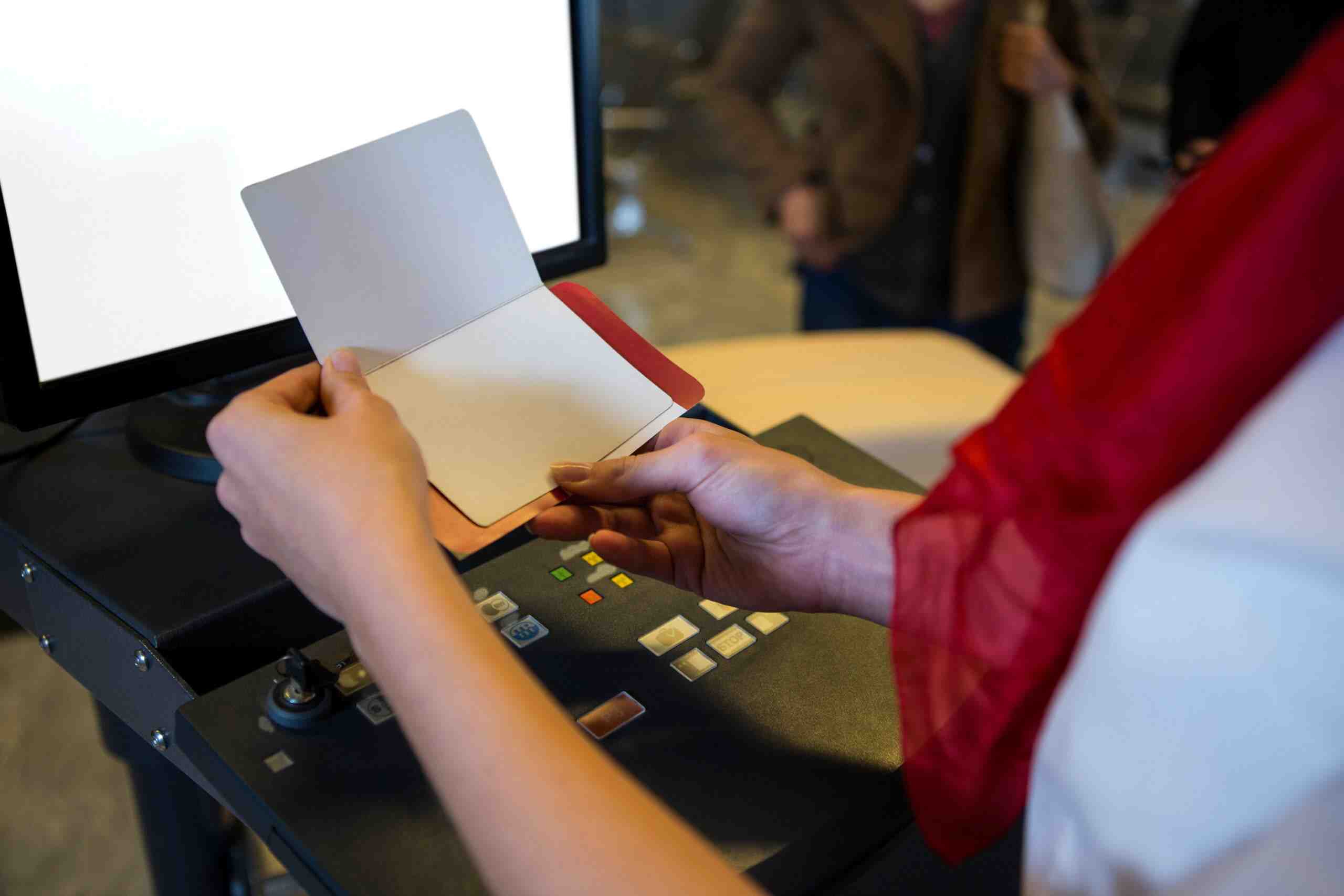

One of the most significant benefits of contactless payments is the speed at which transactions can be completed. Unlike traditional payment methods that require swiping or inserting a card, followed by entering a PIN or signing a receipt, contactless payments allow customers to simply tap their card, smartphone, or wearable device on the POS terminal. This process takes just a few seconds, significantly reducing wait times at checkout.

For businesses, this increased efficiency means they can serve more customers in less time, particularly during peak hours. Faster transactions also lead to shorter queues, enhancing the overall customer experience and potentially increasing sales volume.

2. Enhanced Security

Security is a top priority in any financial transaction, and contactless payments offer a high level of protection. Contactless payments are designed with several layers of security to protect sensitive information. Each transaction is encrypted, and many contactless payments use tokenization, which replaces card details with a unique identifier or token that is useless if intercepted.

Additionally, because the card or device never leaves the customer’s hand, the risk of physical card theft or skimming is reduced. Most contactless payments also have a cap on the maximum transaction amount, adding another layer of security. Combined with the security features of modern POS systems, businesses can ensure that their customers’ payment information is well-protected.

3. Improved Customer Experience

Today’s consumers value convenience, and contactless payments are a perfect fit for this demand. The ease and speed of tapping a card or device to pay make the checkout process more seamless, reducing friction for the customer. This can lead to a better shopping experience and increase customer satisfaction and loyalty.

Contactless payments also align with the growing trend toward a cashless society, particularly among younger, tech-savvy consumers. By offering contactless payment options, businesses can cater to the preferences of a broader customer base, enhancing their competitiveness in the market.

Also read: Why POS Systems Are Essential for Franchise Operations

4. Hygiene and Safety

The COVID-19 pandemic has heightened awareness of hygiene and safety, leading to a surge in the adoption of contactless payments. Because contactless payments eliminate the need for physical contact with the POS terminal, they help reduce the spread of germs and viruses. Customers don’t have to touch shared surfaces like PIN pads or hand their cards to cashiers, making contactless payments a safer option in a world where health and hygiene are top concerns.

For businesses, promoting contactless payments can reassure customers that their safety is a priority, helping to build trust and encouraging repeat business. It’s a small but meaningful way to adapt to the new normal and meet customer expectations for safer shopping environments.

5. Integration with Mobile Wallets

The rise of mobile wallets like Apple Pay, Google Pay, and Samsung Pay has further accelerated the adoption of contactless payments. These digital wallets store payment information securely on smartphones and allow users to make payments with a tap. When integrated with POS systems, mobile wallets offer additional benefits such as digital receipts, loyalty rewards, and the ability to store multiple cards and payment methods.

For businesses, accepting payments from mobile wallets can attract tech-savvy customers and provide opportunities for more personalized marketing. For instance, businesses can use data from mobile wallet transactions to offer targeted promotions or rewards, enhancing customer engagement and retention.

6. Future-Proofing Your Business

As technology continues to evolve, the payment landscape will likely see even more innovations. By adopting contactless payments via POS systems, businesses are positioning themselves to stay ahead of these changes. Contactless payments are no longer just a trend; they are quickly becoming the standard. Businesses that fail to offer this payment option may find themselves at a disadvantage as consumer expectations shift.

Additionally, upgrading to a POS system that supports contactless payments ensures that your business can easily adapt to future payment technologies. This future-proofing not only enhances your current operations but also prepares your business for long-term success.

Conclusion

In conclusion, the benefits of contactless payments via POS systems are clear. They offer speed and efficiency, enhanced security, and an improved customer experience, all while promoting hygiene and safety. Integration with mobile wallets adds another layer of convenience and opportunity for businesses. By adopting contactless payments, businesses can future-proof their operations and meet the evolving needs of their customers in a rapidly changing world. As contactless payments continue to gain traction, businesses that embrace this technology will be well-positioned to thrive in the digital age.

Visit our site at www.dibtech.com.au

Visit our YouTube channel for tutorials Dibtech